The Mortgage Insurance companies don’t seem to think so (at least not in Portland).

So what is Mortgage Insurance (MI)?

Contrary to what it sounds like, MI it is not insurance that your mortgage will be paid if you lose your job. In fact, it is not insurance for you at all, even though you may be paying it every month.

Mortgage Insurance is for the lender holding the loan on the property. The lender will typically require MI on any loan where there is less than an 80% loan to value ratio (LTV). For instance, if the down payment is less than 20%, the lender will likely require MI. The mortgage company wants some sort of insurance that if they lend over that magical 80% LTV mark and if the borrower defaults, they won’t lose their shirts. By having the insurance, the MI will help reduce or eliminate financial loss.

Who are these mortgage insurance companies anyway?

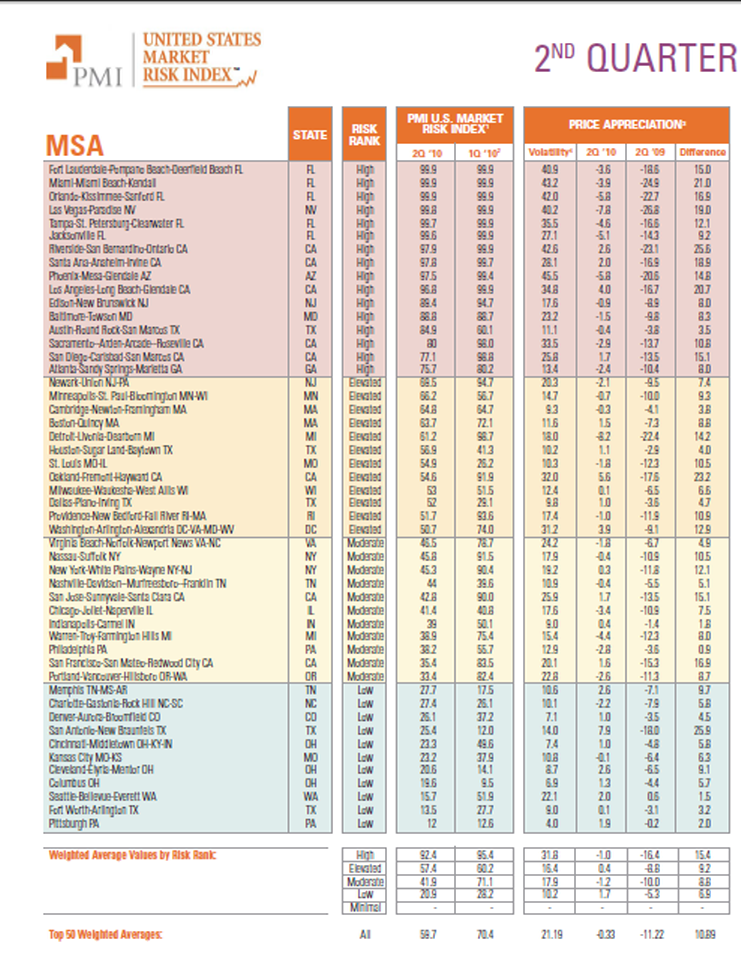

PrivateMI, one of such companies, studies economics, housing, employment, affordability, excess housing supply, interest rates and foreclosure activity, along with many other factors to determine the likelihood of lower home prices in 2 years in a particular metropolitan statistical area (MSA). I kind of view their researchers like actuaries, all they do is measure risk, risk of falling home prices. The risk may be a factor for PMI in deciding if they will indeed offer the insurance, and if so, how much the insurance will cost.

Is there good news?

Yes! Portland-Vancouver-Hillsboro has seen the largest decrease in risk from quarter to quarter in the top 50 Metropolitan Statistical Areas. In fact, the Portland area saw a drop in rate of risk of 49 percentage points from 82.4% to 33.4%. See report below.

What does this mean?

It means that experts, the ones who study this data for a living, are saying that in the next 2 years, Portland has a 33% chance (moderate by their standards) of decreased home values. That coupled with the risk of rising interest rates make this a wonderful time to buy.

Stay Tuned…

Next week learn how rising interest rates could affect you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link