Each day, if you pay attention to news media, you may find yourself either riding a roller-coaster or pulling at an old fashion taffy pull when it comes to the housing market.

The Wall Street Journal had an article “Home Prices Sink Further”: Declines Reported in All 28 Major Metropolitan Areas; Unsold Inventory Piles up”, stating that Portland home values went from approx. 6.25% down in the 2nd Quarter to 12.1% down in the 4th Quarter. As stated in the article, “Falling prices are a reflection of weak demand and tight credit conditions that reduce the number of potential buyers.”

Question: If Portland area homes dropped 6% (approx) in 3 quarters, how much further will they drop in 2011?

OregonLive.com: “University of Oregon Economist “much more optimistic” as Indicators Point to Recovery” by Tim Duy, the economist who prepares the UO Index of Economic Indicators. He states, as one of his supporting factors: Oregon residential building permits rose, although from low levels. “Still,” Duy wrote, “any improvement is welcome in this beleaguered sector.”

Question: So does that mean housing prices are at the bottom and we will see them start to rise?

RMLS Market Action for January 2011: Clackamas County, average sale price down 7.6%, Multnomah County, down 0.1%, and Washington County, down 2.3%. A graph shows that January 2011 average sales price equals the average sales price in January 2005. The number of closed sales were up 5% from a year ago and the new listings dropped 20.5% from January 2010.

Question: Sounds like there is less inventory and more people are starting to value owning real estate again – is this the time for me to consider it as well?

What about the Purchase $?

Although we are experiencing more cash purchasers than in past years, most people do still rely on a loan from a financial institution to purchase their next real estate property.

Many buyers wonder about waiting and hoping interest rates and prices of homes will continue going down?

Question: How much does it matter if the interest rate goes up if the home prices go down? I am just interested in getting the best price for my next property.

Interest rates do very much impact your purchasing power. An example: if a purchaser wants to pay $1000/mth for a mortgage payment with an interest rate of 4.75%, the home purchase price = $191,700 and at 5.25% the home purchase price = $181,092 — - so a difference of around $10,000 in home sales price for the ½ point interest rate or over 5% purchasing power.

So, again, To Buy or Not to Buy? We have seen the interest rates creep up in just the past week. Every indication says that there are fewer active listings on the market, we are seeing multiple offers in place once again (something we have seen very little of in the past 18-24 months) and indicators are stating the economy is growing. So you must ask yourself, if you are on the fence – will the prices continue to drop in Portland or are they stabilizing while the interest rate is rising?

The Reality: You actually may be losing $ while you wait.

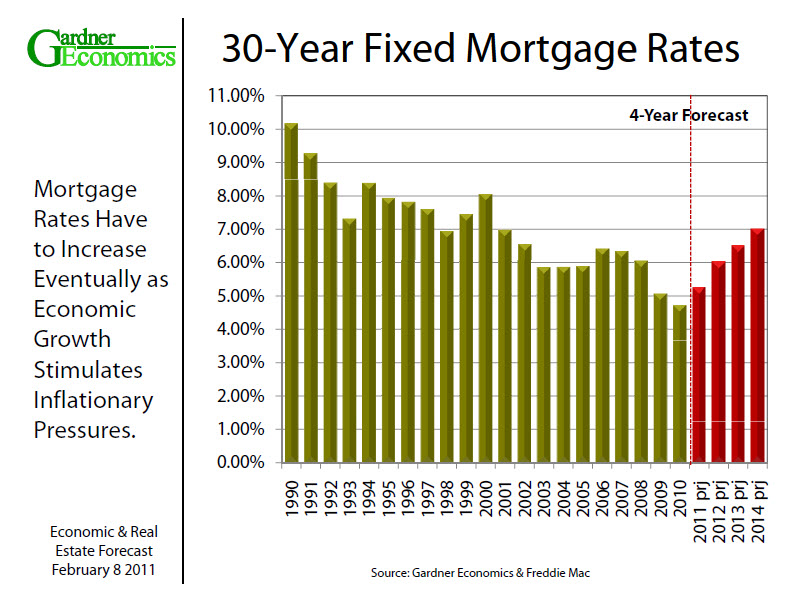

For interest rate projections, see economist, Matthew Gardner’s graph below:

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link